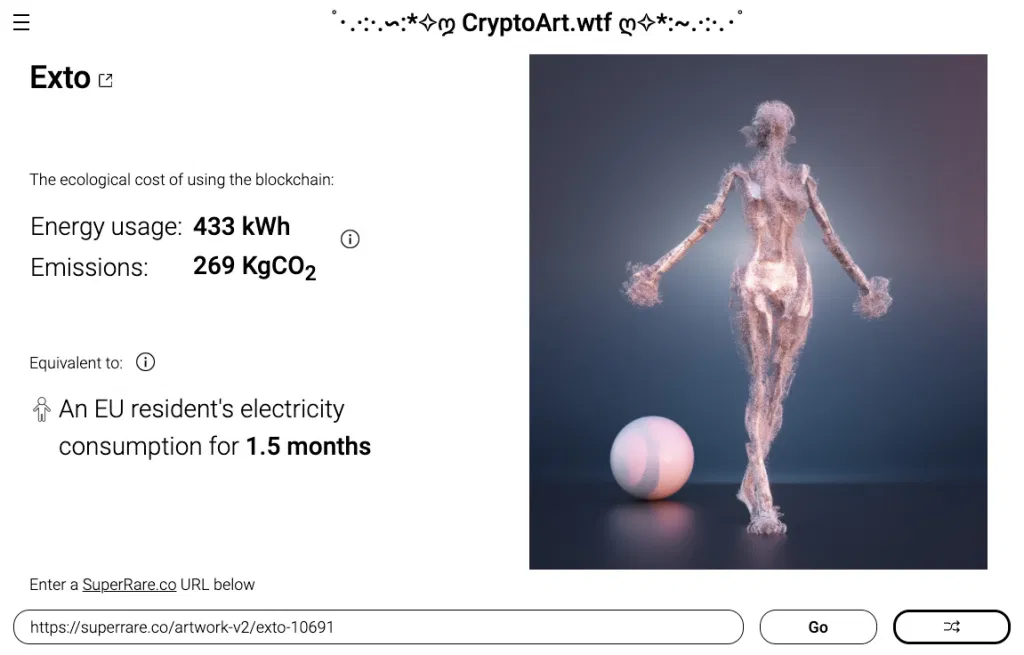

The calculations of cryptoart.wtf ignore the central role of the Ethereum block reward in incentivizing mining. This mistake invalidates the site's findings.

Cryptoart.wtf's content has recently been replaced with a holding page for unrelated reasons, but its mistaken conclusions feature in many articles critical of the ecological footprint of NFTs on the Ethereum network. I hope this post helps set the record straight.

The calculation

On this page Memo explains how the energy cost of a piece of cryptoart is calculated on the site. The calculation depends on adding up the gas costs of all transactions associated with the artwork being analysed. He writes:

Since the energy required and footprint of mining a block is independent of its contents and number of transactions, the Gas required by a transaction is representative of the portion of a block’s footprint it will incur

From the total amount of Ethereum Gas and energy consumed by the Ethereum network over a period we can calculate the energy footprint per unit of Gas. Then we can calculate the footprint of a particular transaction from the amount of Gas that it used.

At first glance this looks odd when you know that gas used in a block and energy used to mine that block are largely independent; Empty blocks cost as much energy to mine as full ones under the same network conditions. It might look like this invalidates any attempt to apportion eco impact to transactions. But if a transaction increases the amount of future mining that occurs it may still be possible to assign it an energy footprint.

The air travel analogy

We calculate emissions footprints for plane tickets. Can the same approach be applied to transactions to the Ethereum network? Memo writes:

There is a common fallacy along the lines of “The same energy will be consumed whether a block is empty or contains your transaction, thus a transaction has no impact on the energy consumption of a block being mined, or on the environment”. This is based on a gross misunderstanding of what a carbon footprint is.

This statement is analogous to claiming “when a 500 tonne airplane flies from NYC to LA, it consumes the same amount of fuel whether I ride it or not (because the weight of a person is negligible compared to the weight of the plane). Thus my flying has no impact on the environment”.

It is true that one person deciding to fly (or not) does not have an immediate effect on emissions. However, there is a footprint associated with a seat on a plane.

Each ticket sold is effectively a signal telling the airline Keep scheduling flights! This is how buying a ticket can be causally linked with emissions even if physically travelling on the plane didn’t increase the emissions of that flight at all (or if you simply missed the flight).

How well does this approach map to the Ethereum network? There’s an important difference between the incentive structure faced by an Ethereum miner and that faced by an airline that complicates things.

Captain pollution

Imagine that an airline received a large financial reward from a mysterious eco-villain for each flight it completed. The reward was issued whether or not any seats on the flight were occupied. Imagine too that this reward was many times greater than the revenue from the tickets sold for any fully-booked flight.

Under these circumstances it wouldn’t be appropriate to apportion the entire ecological impact of a flight only to those who’d bought tickets, because this ignores the incentivizing effect of the reward. Indeed the eco-villain is incentivizing the airline to schedule flights more than the ticket buyers are.

Memo's calculations on cryptoart.wtf are doing the equivalent of ignoring Captain Pollution's reward.

Incentives to mine

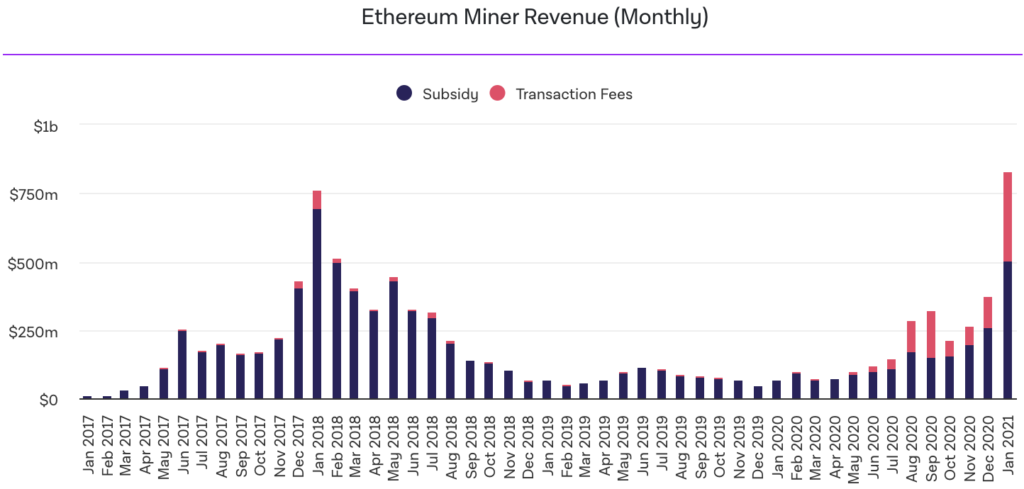

Successful miners on the Ethereum network are currently rewarded in two ways.

- By receiving a block reward, which is an amount of newly created ETH

- By receiving transaction fees (gas fees), an amount that users of the network send along with their transaction. This source of revenue looks set to be dramatically reduced by an upcoming change to the network

Here’s a breakdown of miner revenue into block reward (Subsidy) and transaction fee parts for the last several years. For most of Ethereum's history the subsidy part has been close to 100% of total revenue. Recently it has approached 50%.

The Ethereum block reward is analogous to the eco-villain's reward to the airline company. Successful miners receive the reward regardless of what’s in the blocks, and it’s usually very large compared to the revenue from transaction fees (which are analogous to ticket sales in our thought experiment).

For the same reason that it wouldn’t be appropriate to ignore the eco-villain’s reward and divvy up the entire ecological impact of a flight between ticket buyers, it’s also not appropriate to apportion the entire energy footprint of block mining to those making transactions within those blocks.

Cryptoart.wtf incorrectly calculates as though transaction fees are the only incentivizer of mining. The block reward is a major and largely independent incentive too.

TLDR

What I’m not arguing in this article:

- It’s wrong to be critical of proof of work systems

- Cryptoart NFTs are unambiguously a great idea

What I am saying, specifically: Cryptoart.wtf’s reports of the energy use of NFTs are wrong; the calculation used there isn’t valid, and any article depending on them is also in error. This truth should be relevant to anyone considering this topic regardless of their stance on Ethereum or NFTs.

Notes

This post grew from a Twitter thread. In that thread I didn't address the possibility that transactions can validly be assigned eco footprint based on their incentivization of future mining work. I believe this post does a better job of characterizing the problem with the calculation.

While outside the scope of this post, I'm not convinced that the Ethereum (or Bitcoin) networks currently use too much energy, since this implies to me that the costs of those networks outweigh their benefits - or that they could have successfully bootstrapped without implementing proof of work systems. I believe the benefits of decentralized currency and computing for humankind are hard to overstate.

Another source of miner revenue is MEV (Miner Extracted Value). Because much MEV activity cannot currently be detected, the upper bound of MEV is unclear. This means that even if cryptoart.wft's calculations were altered to account for the effect of the block reward incentive on mining behavior and known MEV, this arithmetic could only establish an upper bound on the energy footprint of a set of transactions.

Thanks to Justin Goro for corrections and suggestions. Any mistakes that remain are my own.

Read more? All articles

I create videos with the help of my patrons great and small.

Find out more about supporting my work.

Would you like to get emails now and then when I publish new things? Leave your address here.